India’s Banks Alarmingly Unprepared for Climate Risk, New Report Cautions

India’s top banks lag in climate readiness, risking financial stability and missing green finance opportunities.

India’s largest banks are failing to keep pace with the accelerating threat of climate change, with only two out of 35 banks implementing coal exclusion policies and a mere seven disclosing full emissions data, reported Bengaluru-based think tank Climate Risk Horizons in its latest study.

The report paints a stark picture of a sector lagging far behind global standards, potentially jeopardizing India’s financial stability and climate goals.

CRH’s Unprepared III report, the third in its series tracking the financial sector’s climate readiness, evaluated India’s top 35 scheduled commercial banks — representing a combined market capitalization of ₹4.58 trillion ($54.91 billion) — using updated international climate disclosure standards.

The findings reveal a persistent lack of climate integration despite the growing economic toll of climate events and intensifying regulatory scrutiny.

Banks Missing in Action

Only 8 banks disclosed their Scope 1, 2 and 3 emissions along with their methodologies, and just 7 had these independently verified.

Despite a modest improvement from 6 banks in 2022, 14 percent of the assessed institutions still disclose no emissions at all.

Yes Bank, HDFC Bank, and Punjab National Bank are the only banks to disclose any information on financed emissions—the greenhouse gases associated with their lending portfolios. HDFC alone reported 12.2 million tonnes of carbon dioxide equivalent emissions from a ₹1.5 lakh crore sample.

Meanwhile, 28 banks remain silent on how their loan books contribute to climate change.

Coal Still on the Books

Only RBL Bank and Federal Bank have adopted policies explicitly excluding coal financing.

The rest of the sector remains exposed to coal and other carbon-intensive industries, contradicting India’s net-zero commitments and international climate finance trends.

This leaves Indian banks vulnerable to transition risks as global capital flees fossil fuels.

Scenario Analysis and Climate Risk Management Still Nascent

Only 13 banks reported undertaking climate scenario analysis. Among them, Kotak Mahindra Bank and IDFC First Bank stood out for conducting climate stress tests.

Yet, nearly half of all assessed banks have not begun integrating climate scenarios into their risk frameworks.

Despite 28 banks establishing climate-related governance mechanisms such as dedicated committees or policies, disclosure and implementation gaps persist.

Only 16 banks had board-level ESG risk committees disclosing their methodology for assessing climate risks.

Sustainable Finance: A Missed Opportunity

India’s banks are also falling short in green lending. Only Federal Bank disclosed a breakdown of its ₹6,962 crore green loan portfolio, categorized by activity such as renewable energy and green buildings.

HDFC Bank and SBI are leading in renewable energy financing with ₹22,026 crore and ₹47,418 crore, respectively, yet most banks failed to disclose any sustainable finance numbers.

With global clean energy investments hitting a record $1.8 trillion in 2023, Indian banks risk missing out on a rapidly expanding and lucrative financial segment.

Six banks— Yes Bank, IDFC First Bank, and SBI — have declared net-zero targets. However, most lack clarity on whether these targets are absolute or intensity-based.

Yes Bank is the only one to commit to a net-zero target for Scope 1 and 2 emissions by 2030.

Global and Regulatory Pressure Mounts

Internationally, climate-related disclosure frameworks like IFRS S2 and regulatory crackdowns — including fines from the European Central Bank — are raising the bar.

India’s regulators are ramping up efforts: the Reserve Bank of India recently introduced its Climate Risk Information System and is finalizing climate stress testing guidelines. However, challenges remain in capacity, data access, and regulatory clarity.

The Securities and Exchange Board of India has mandated sustainability reporting for the top 1,000 listed entities, but faces criticism for diluted standards and inadequate enforcement.

Path Forward: CRH’s Recommendations

CRH urges the RBI and the government to accelerate reforms through:

- Mandatory financed emissions disclosure.

- Government-backed guarantees and incentives for green lending.

- A national climate finance taxonomy aligned with RBI’s disclosure frameworks.

- Regulatory flexibility on provisioning for green projects.

The report calls for banks to integrate climate risks into enterprise risk management, invest in climate-linked financial products, build internal capacity and enhance transparency through verified disclosures and detailed sustainable finance reporting.

Systemic Financial Risk Looms

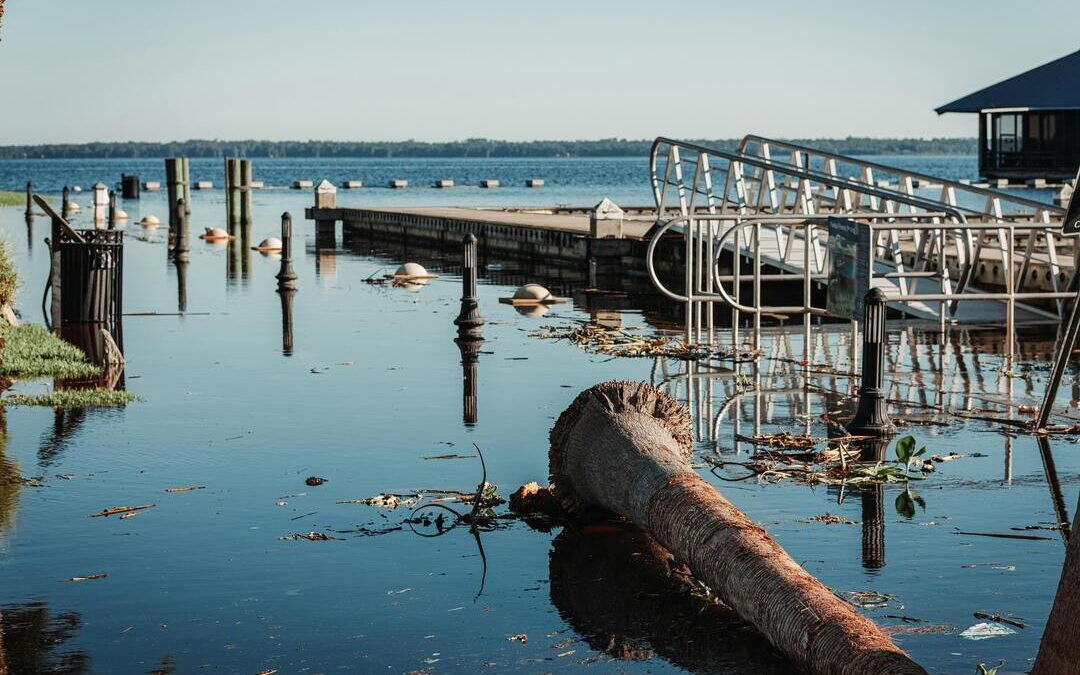

The report warns that climate change could significantly increase non-performing assets, particularly in sectors like agriculture and infrastructure.

A 1 percent increase in typhoon damage raised NPAs by 2.3 percent in the Philippines — a cautionary signal for India.

“The banking sector is not just unprepared; it’s ignoring one of the biggest systemic risks of our time,” said Sagar Asapur, lead author and head of sustainable finance at CRH.

With India’s climate exposure rising and trillions needed to fund a green transition, the failure of its banks to act decisively could imperil both the economy and the environment.

Nirmal Menon

Related posts

Subscribe

Error: Contact form not found.