Global Low-Emissions Hydrogen Growth Slows but Remains on Track to 2030: IEA

Global low-emissions hydrogen growth faces setbacks due to delays and costs, but remains on track for a substantial expansion in 2030.

Global low-emissions hydrogen growth is set to continue strongly by 2030 despite a wave of project cancellations, high costs and policy uncertainty, according to the International Energy Agency’s latest “Global Hydrogen Review.”

The report, published on Friday, said global hydrogen demand rose 2 percent in 2024 to nearly 100 million tonnes, with most of it still supplied from fossil fuels without emissions controls. While demand is expanding, growth in low-emissions hydrogen is lagging behind targets set by governments and industry.

Production Outlook Weakens

The IEA said new project delays and cancellations had cut the potential 2030 production capacity for low-emissions hydrogen to 37 million tonnes per year, down from 49 million tonnes projected a year ago.

Actual capacity is likely to be much lower, as not all projects announced reach completion. However, production from projects already operating, under construction or with final investment decisions could increase more than fivefold from 2024 levels to exceed 4 million tonnes annually by 2030.

An additional 6 million tonnes of production could come online if stronger demand-side policies are implemented, the IEA said.

“Investor interest in hydrogen jumped at the start of this decade thanks to its potential to help countries deliver on their energy goals,” said IEA Executive Director Fatih Birol. “The latest data indicates that the growth of new hydrogen technologies is under pressure due to economic headwinds and policy uncertainty, but we still see strong signs that their development is moving ahead globally.”

Hydrogen made from fossil fuels remains significantly cheaper than low-emissions production, the report said, as falling natural gas prices and rising electrolyser costs widened the gap in recent years.

The IEA expects the cost difference to narrow by 2030 as technology prices fall, renewable energy expands and new regulations take effect in some regions.

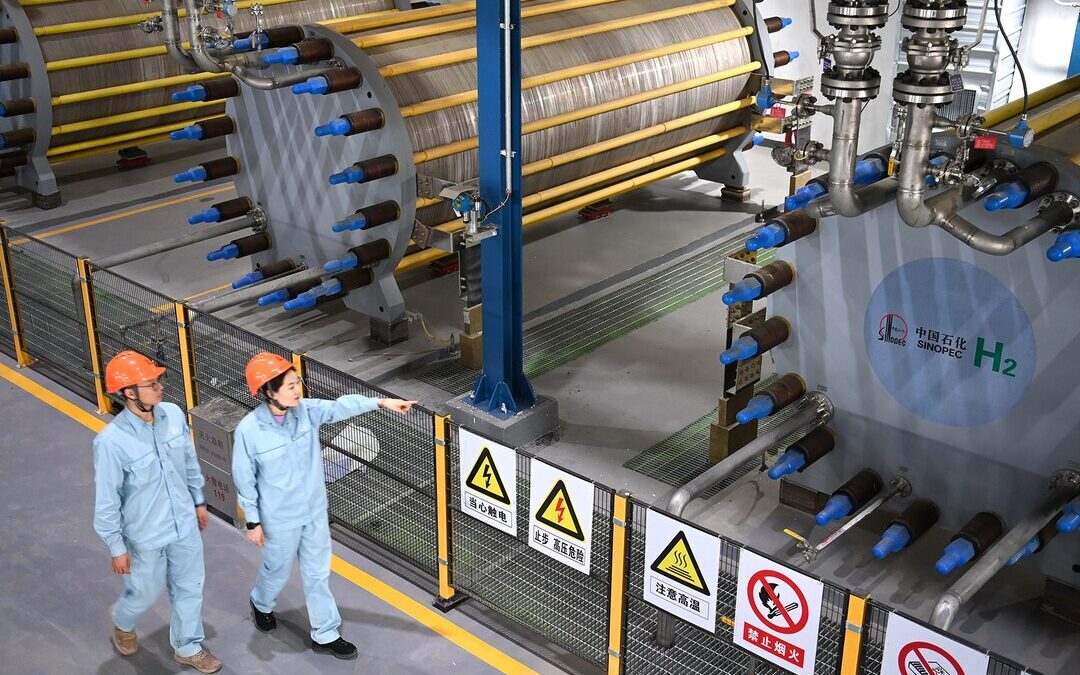

China Leads Electrolyser Deployment

China accounts for 65 percent of installed or committed global electrolyser capacity and nearly 60 percent of global electrolyser manufacturing, making it the leading force in low-emissions hydrogen deployment.

However, Chinese manufacturers may face challenges in the future, with over 20 gigawatts of annual capacity far outstripping current demand. Outside China, producers face financial pressure from higher costs and slower uptake.

The report found that the cost of installing Chinese-made electrolysers abroad was not significantly cheaper than those from other producers once transport and tariff costs were considered.

Hydrogen-based fuels could play a role in decarbonising shipping, but widespread adoption will require investments in compatible technologies and port infrastructure, the IEA said.

Nearly 80 ports worldwide already have expertise in managing chemical products, positioning them well to handle hydrogen fuels. Many existing bunkering facilities are located near potential low-emissions hydrogen production sites, presenting early opportunities for deployment.

Southeast Asia Emerges

The report highlighted Southeast Asia as a growing hydrogen market. Announced projects in the region could bring production to 430,000 tonnes a year by 2030, up from just 3,000 tonnes today.

Most projects remain in early development stages, requiring faster renewable deployment, stronger policies and more pilot projects to realise their potential, the IEA said.

The IEA said sustained policy backing will be vital to accelerate hydrogen uptake. It also launched an updated Hydrogen Production and Infrastructure Projects Database and a new online tracker to monitor global project pipelines, costs and policy measures, reflecting the continued importance of global low-emissions hydrogen growth.

Also Read:

Global Hydrogen Investment Surges to $110B as 1st Wave of Projects Come Online

Nirmal Menon

Related posts

Subscribe

Error: Contact form not found.