India Unveils GST Reforms to Boost Green Growth and Cut Emissions

India cuts GST on clean energy, transport and biodegradable goods to boost climate action and support sustainable growth.

India announced sweeping changes to its goods and services tax structure aimed at accelerating clean energy adoption, improving waste management and curbing pollution, in what the government called a “historic step” toward a greener economy.

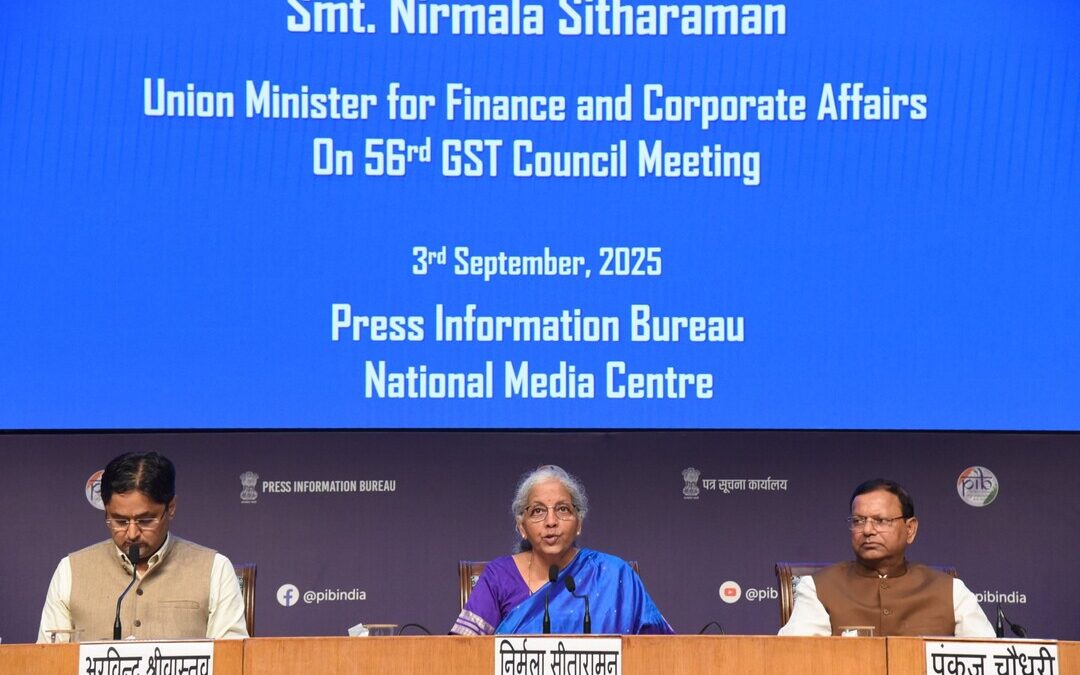

The reforms, cleared on Sept. 3, cut tax rates on renewable energy equipment, biodegradable alternatives to plastic, effluent treatment services and commercial transport vehicles.

Officials said the changes will lower project costs, stimulate domestic manufacturing and encourage investments aligned with India’s climate goals.

Union Environment Minister Bhupender Yadav hailed the measures as “GST reforms for a Green India,” saying they would support Prime Minister Narendra Modi’s vision of balancing fiscal needs with environmental protection.

Renewable Energy Push

Tax reductions on solar panels, photovoltaic cells, wind turbines and related devices are expected to lower capital costs and make renewable projects more viable, the government said.

Cheaper inputs could help bring down tariffs for consumers and strengthen domestic production under India’s production-linked incentive schemes.

“Renewable energy will remain the backbone of India’s climate strategy,” Yadav said on social media platform X, congratulating Modi and Finance Minister Nirmala Sitharaman.

Waste Management and Pollution Control

The GST on services provided by common effluent treatment plants was reduced from 12 percent to 5 percent, a move officials said would encourage industries and municipal corporations to adopt centralized treatment solutions.

The government expects the change to create green jobs in plant operations, segregation and maintenance.

In a bid to curb plastic waste, the tax on biodegradable bags has been cut from 18 percent to 5 percent, making them more affordable for consumers and retailers.

Authorities said the measure would accelerate the shift away from single-use plastics and promote investment in bio-polymers and compostable materials.

Transport Sector Incentives

Passenger buses with more than 10 seats and commercial goods vehicles will now attract a GST of 18 percent, down from 28 percent.

The government said lower upfront costs would encourage fleet expansion and modernization, reducing congestion, emissions and dependence on outdated vehicles.

India has pledged to achieve net zero emissions by 2070 and fulfill its obligations under the Paris Agreement. Officials said the GST rationalization would help align economic growth with environmental sustainability.

“The reforms will aid waste management, lower emissions and protect ecosystems, while ensuring fiscal balance,” Yadav said.

Nirmal Menon

Related posts

Subscribe

Error: Contact form not found.