Only 15% of Carbon Projects Deliver Measurable Biodiversity Conservation

JPMorgan report urges stronger biodiversity conservation standards to align carbon markets with global nature and climate goals.

Nearly 85 percent of nature-based carbon removal projects in the voluntary carbon market fail to deliver measurable outcomes for biodiversity conservation, according to new research by JPMorgan Chase & Co.

The study, led by Gwen Yu, head of emerging sustainability issues at JPMorgan Chase, analyzed 1,639 nature-based carbon projects registered globally under Verra, ACR and the Climate Action Reserve.

It found that only 15 percent were designed with measurable metrics for biodiversity conservation, highlighting a major gap between carbon and nature goals.

“Our findings show that most projects in the voluntary carbon market were never structured to achieve nature-positive outcomes,” Yu said. “Carbon remains the dominant driver, while biodiversity conservation has largely been treated as a secondary co-benefit.”

The report, “Optimizing for Biodiversity with Nature-Based Projects in the Voluntary Carbon Market,” released jointly with Carbon Direct, offers a framework for integrating biodiversity into project design, measurement, and reporting.

It introduces six guiding principles to ensure high-integrity, dual outcomes for carbon and biodiversity conservation in the VCM.

Global Finance Still Skewed Toward Carbon

According to the report, climate finance reached about US$1.9 trillion in 2023, compared with only US$200 billion for nature-related projects.

Both are less than one-third of the funding required to meet international goals under the Kunming-Montreal Global Biodiversity Framework by 2030.

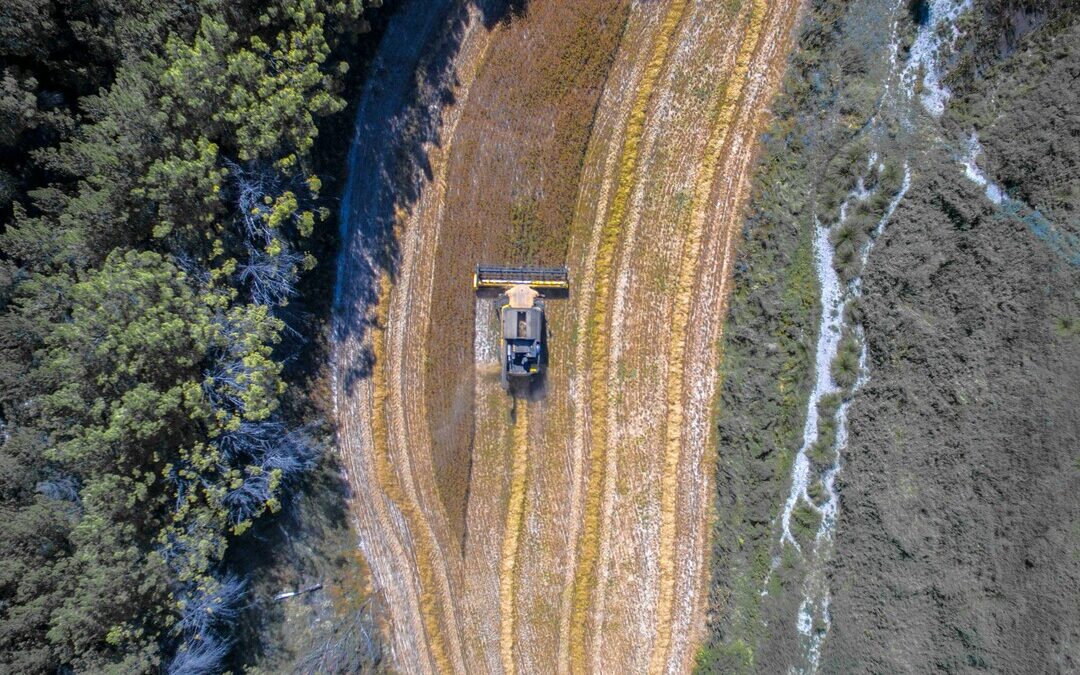

Nature-based solutions such as reforestation and improved forest management now account for more than half of all carbon credits in circulation.

However, the authors warn that these projects often prioritize rapid carbon sequestration over biodiversity conservation, particularly when they rely on fast-growing monocultures like eucalyptus or pine.

“Projects that maximize carbon in the short term may undermine local ecosystems in the long run,” Yu said. “For credible biodiversity conservation, we need diversified habitats, native species, and community stewardship to ensure ecological resilience.”

The study also notes that projects with measurable biodiversity benefits are more likely to attract premium buyers.

In 2023, credits certified with co-benefits such as biodiversity conservation fetched a 37 percent higher price on average compared with standard carbon credits, indicating a growing market demand for verifiable nature outcomes.

Six Principles for Dual Outcomes

The paper outlines six core principles for integrating biodiversity conservation within the voluntary carbon market:

- Center local context for global impact — Projects must account for geographic, ecological and cultural differences, as biodiversity is not fungible.

- Adopt adaptive management — Project management should evolve with new data and community feedback while preventing greenwashing.

- Take the long view — Biodiversity recovery and carbon sequestration often occur on different timelines; reporting frameworks must reflect this.

- Ground measurement in science — Data collection should follow evidence-based methods and transparent monitoring, measurement, reporting, and verification.

- Engage local and Indigenous communities — Long-term biodiversity conservation depends on local participation, equitable benefits, and traditional ecological knowledge.

- Ensure durability of outcomes — Projects should maintain verifiable results across decades, not just within short carbon crediting periods.

Yu emphasized that adhering to these principles could transform the VCM into a catalyst for ecosystem restoration. “Buyers can shape this market,” she said. “When organizations fund projects that prioritize both carbon and biodiversity conservation, they create a compounding benefit for climate, nature, and communities.”

Misaligned Incentives and Measurement Gaps

The study warns that current market structures reward projects that optimize for carbon but neglect biodiversity.

Metrics such as tons of carbon dioxide removed are standardized and easily verified, while biodiversity outcomes — like species richness, habitat connectivity, or genetic diversity — are more complex to quantify and compare.

As a result, developers often default to low-cost, uniform approaches that deliver fast carbon credits but poor biodiversity conservation performance.

The report calls for global standards to harmonize biodiversity metrics and integrate them into carbon protocols to prevent “carbon-only” project design.

Yu said this integration is both an economic and ecological imperative. “Healthy ecosystems are the foundation of climate resilience,” she said. “Without biodiversity conservation, the carbon benefits we’re counting on may not be sustainable.”

Toward a Nature-Positive Carbon Market

JPMorgan’s framework comes as corporations, investors and governments increasingly look to combine carbon neutrality strategies with measurable nature outcomes.

By embedding biodiversity metrics into the VCM, the paper argues, the private sector can accelerate financing for nature without waiting for standalone biodiversity credit markets to mature.

Yu said the study is not a prescriptive policy document but a call for collaboration. “We need to move from theory to practice,” she said. “There’s a growing recognition that climate and nature must be addressed together. Biodiversity conservation isn’t just a co-benefit—it’s a prerequisite for a stable planet.”

The report concludes that aligning project design, finance and reporting systems around biodiversity conservation will help create a more resilient, transparent and equitable carbon market.

Also Read:

ISO Unveils World’s 1st Biodiversity Standard to Drive Corporate Action

Only 15% of Carbon Projects Deliver Measurable Biodiversity Conservation

Nirmal Menon

Related posts

Subscribe

Error: Contact form not found.